Top Benefits of Outsourced Accounting Services for CPA Firms in the USA

Top Benefits of Outsourced Accounting Services for CPA Firms in the USA Introduction In today’s dynamic U.S. market, CPA firms...

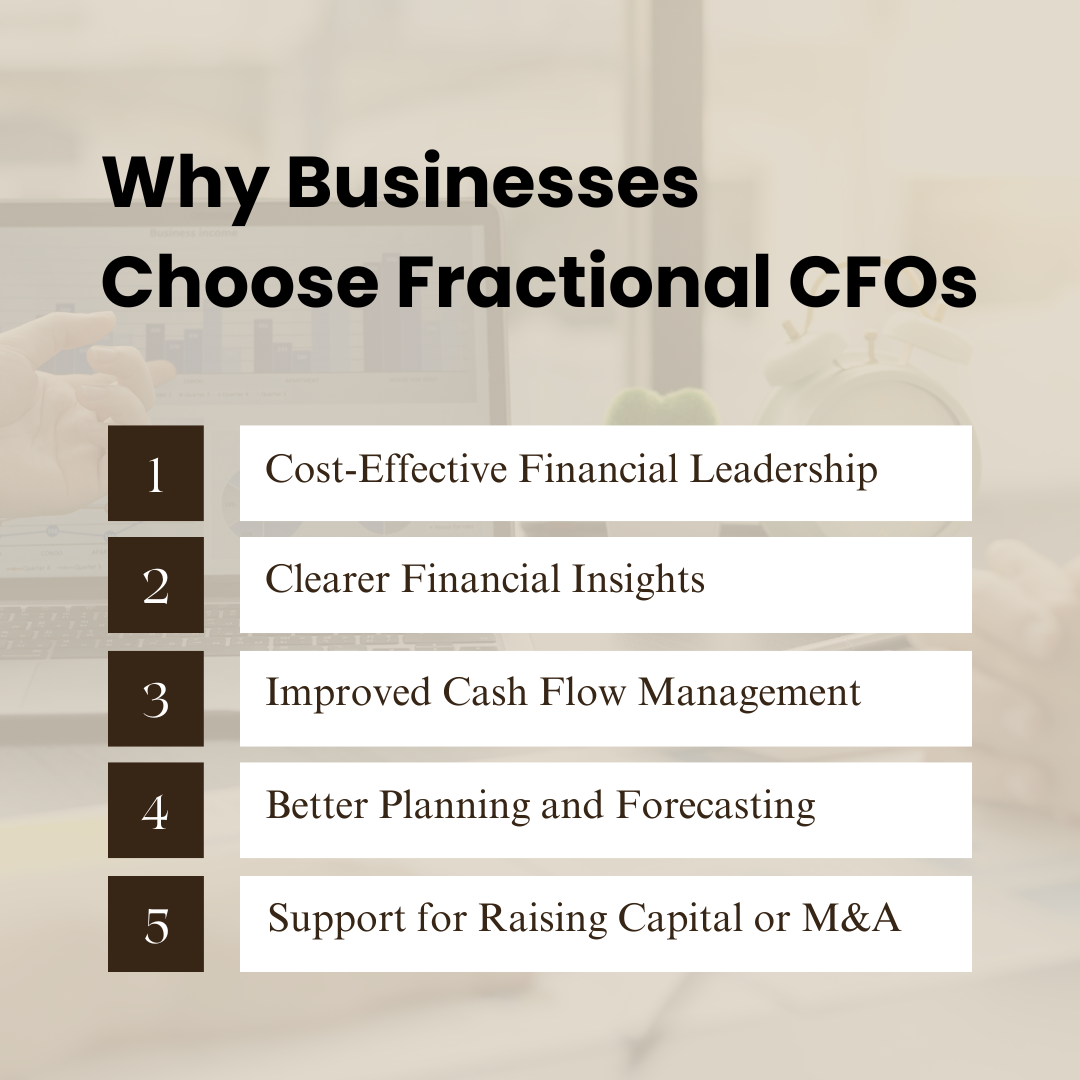

In today’s competitive environment, businesses must make informed financial decisions to stay profitable and grow. But not every business has the resources or need for a full-time Chief Financial Officer. That’s where fractional CFO services come into play. These services offer strategic financial expertise without the full-time commitment or cost, making them a smart solution for small and mid-sized businesses across the United States.

A fractional CFO is a senior-level financial expert who works with your company on a part-time or contract basis. They provide high-level guidance to help improve financial performance, manage risk, and support growth initiatives. These professionals often have experience across various industries and business models and can step in to guide financial planning, reporting, forecasting, and strategy development.

Hiring a full-time CFO can be expensive, with costs including salary, bonuses, and benefits. Many businesses, especially startups or those with lean teams, find it more practical to work with a fractional CFO.

Here’s why:

1. Cost-Effective Financial Leadership

Fractional CFOs deliver the same expertise as full-time executives but at a lower cost. You only pay for the services you need, whether that’s a few hours per week or support during a specific growth phase.

2. Clearer Financial Insights

A fractional CFO brings clarity to your financial reports. They help you understand your numbers, identify patterns, and make decisions based on real-time data.

3. Improved Cash Flow Management

One of the biggest challenges for small businesses is managing cash flow. A CFO can help build cash flow forecasts, monitor expenses, and suggest improvements to ensure your business remains financially healthy.

4. Better Planning and Forecasting

Planning for the future is easier with a professional who understands the numbers. A fractional CFO creates detailed budgets and forecasts based on market trends, seasonal changes, and your business goals.

5. Support for Raising Capital or M&A

Suppose your company is preparing to raise funding, apply for a loan, or go through a merger or acquisition. In that case, a fractional CFO ensures your financial records are accurate and your business is prepared for due diligence.

Here’s how these services help boost profitability:

Strategic Cost Management

Fractional CFOs evaluate where money is being spent and find opportunities to reduce costs without affecting quality or output. These savings directly contribute to your bottom line.

Revenue Growth Strategies

They help identify which products or services generate the highest returns, allowing you to focus your energy on the most profitable areas of the business.

Operational Efficiency

By streamlining financial processes, such as billing, payroll, and vendor payments, CFOs help reduce errors, save time, and free up resources.

Data-Driven Decisions

With better financial modeling and forecasting, you can make decisions backed by numbers. This minimizes guesswork and improves your return on investment.

At SimpleBooksLA, we’ve worked with a variety of industries that benefit from fractional financial support, including:

Restaurants and Hospitality

We assist restaurant owners in managing tight margins, labor costs, inventory, and vendor payments. With seasonal fluctuations and rising expenses, having financial clarity is critical.

Real Estate

From cash flow planning for property investments to understanding tax strategies, real estate professionals benefit from expert financial oversight that ensures long-term profitability.

E-commerce and Retail

CFOs help online businesses manage inventory costs, plan for peak sales periods, and evaluate customer acquisition strategies.

Healthcare and Clinics

With complex billing systems and regulatory requirements, fractional CFOs help healthcare providers streamline financial operations and improve collections.

You might benefit from fractional CFO services if:

Fractional CFO services give small and mid-sized businesses the chance to access high-level financial expertise without the overhead of a full-time hire. From improved budgeting and forecasting to strategic guidance and cost control, a fractional CFO helps position your business for growth and stability.

At SimpleBooksLA, we specialize in helping real estate firms, restaurants, and service-based businesses in the U.S. achieve financial clarity and control. If you want to strengthen your financial strategy and drive real results, consider adding a fractional CFO to your team.

Top Benefits of Outsourced Accounting Services for CPA Firms in the USA Introduction In today’s dynamic U.S. market, CPA firms...

Why Smart Restaurateurs Rely on Professional Accounting Services Introduction Running a successful restaurant goes beyond serving mouth-watering dishes or providing impeccable...

Hire an Expert Bookkeeper in USA: Tips, Benefits, and Reasons for Your Business Introduction Managing finances is one of the biggest...